| Investor's Guide |

|---|

| INTRODUCTION |

| WHAT IS STOCK EXCHANGE? |

| A stock exchange, share market or bourse is an organization which provides "trading" facilities for stock brokers and traders, to trade shares of the listed companies and other financial instruments such as Term Finance Certificates and Derivatives. Stock exchanges also provide facilities for the issue (listing), redemption (delisting) of securities and other capital events including the payment of income and dividends. Pakistan Stock Exchange Limited (formerly: Karachi Stock Exchange Limited) - PSX is a modern market where trading takes place with electronic trading system called Karachi Automated Trading System (KATS), which gives the Exchange advantages of speed and minimum cost of transactions. Trades on an exchange are by members only. |

| WHY DO COMPANIES GO PUBLIC? |

| The primary purpose for companies to be publicly listed at the exchange is to cost-effectively raise capital. It reduces the company's reliance on the traditional financiers such as financial institutions and individuals. Listing allows business expansion without increasing borrowings or draining the company's cash reserves. History of listed companies indicate that companies that convert to public ownership are more likely to become successful than control companies that remain private. Companies that go public are also more likely to become acquirers than control companies. IPO companies grow faster than control companies after going public. However, both public and private companies must disclose financial information to regulators. |

| WHAT ARE SHARES? |

| Shares, as the name says, are shares in a limited company. Each shareholder is a partial-owner of the company in which they have bought shares and investors can buy and sell their shares on the stock exchanges. Companies on incorporation issue shares, (also called equities) and later perhaps when they are building up a business. The original shareholders might still own them, or they may have sold them to someone else through the stock market. If the company makes a profit, the shareholders normally have some of it passed to them in the form of dividends. The amount paid in dividends varies year by year, depending on how profitable the company has been and how much money the directors and the company management want to keep in reserve for future expansion. |

| There are different ways in which you can participate in the stock market: |

| 1. Directly: by buying and selling shares; |

| 2. Indirectly: through a collective vehicle, in which shares are grouped together, such as a mutual fund or Exchange Traded Funds (ETFs). |

| THE INITIAL OFFERING OF STOCKS (IPO): |

| The initial offering of stocks and bonds to investors is by definition done in the primary market (IPO) and subsequent trading is done in the secondary market. Initial Public Offering (IPO) is the initial sale by a company of shares of its stock to the public in the financial market. |

| BOOK BULIDING PROCESS FOR NEW COMPANIES: |

| Book Building is the process of price discovery and pricing a new share issue. The process by which an underwriter attempts to determine, at what price to offer an IPO based on demand from institutional investors for its efficient price discovery based on actual supply and demand by informed investors. |

| REGULATING THE STOCK MARKET |

| HOW DOES PSX REGULATE TRADING ACTIVITIES? |

| The regulatory authority for the securities market and corporate sector in Pakistan is the Securities and Exchange Commission of Pakistan (SECP). The SECP administers the compliance of the corporate laws in the country and is run by commissioners under a chairman. |

| The Securities and Exchange Commission of Pakistan, is an autonomous regulatory authority, and at the same time provides an accountability mechanism through establishment of a Securities and Exchange Policy Board. All policy decisions are made by the board on the recommendations of the commission and the board is directly answerable to the Parliament. |

| THE REGULATORY INFRASTRUCTURE OF PAKISTAN STOCK EXCHANGE |

| Trading Rights Entitlement Certificate Holders (TREC Holders) of the stock exchanges and trading at the Exchange are also subject to the discipline of self-regulation under PSX Rule Book of the Stock Exchanges. |

| Trading activities are being monitored through the surveillance terminal to ascertain that, there are no illegal postings and dealings made in any of the issues listed in the Exchange. Through the Compliance and Surveillance Group, compliance of TREC Holders with applicable regulatory framework is monitored. |

| MARKET AND IT'S WORKING |

| WHAT ARE THE MEASURES OF MARKET PERFORMANCE? |

| There are four indicators of market performance: |

| a. Market Capitalization |

| b. Value Turnover |

| c. Traded Volume |

| d. Composite Index |

| WHAT INFLUENCES MARKET MOVEMENTS? |

| General investors' sentiment indicates the direction of the market movement. However, the over-all market sentiment is influenced by a number of factors - economic, political, fiscal, etc. |

| HOW DO OTHER ECONOMIC INDICATORS AFFECT THE MARKET? |

| Interest rates, foreign exchange, inflation, growth rates - these are some other economic indicators, which affect the performance of the Stock Market. Favorable growth and inflation rates, as well as stabilized interest rates and foreign exchange, are good news for the stock market. They usually give a boost to the market performance as these indicate sound economic status. Soaring interest rates, on the other hand, usually push investors from the stock market to some interest-bearing investments, as they offer better returns than stock investing. |

| WHAT ARE STOCK MARKET INDICES? HOW DO THEY WORK? PSX INDEX: |

| Pakistan Stock Exchange Limited (formerly: Karachi Stock Exchange Limited) KSE-100 Index is the bench mark for our market, it comprises of the top companies from each of the 34 sectors on the PSX, in terms of market capitalization. The rest of the companies are picked on market capitalization ranking, without any consideration for the sector to make a sample of 100 common stocks with base value of 1,000 in late 1991. There are two other indices; KSE-30 Index, which is based on free float capitalization of top 30 companies and KSE all shares Index which is based on full market capitalization of all listed companies at the Exchange. |

| An index, a composite figure, becomes a benchmark index when you choose it as the standard against which to measure your own portfolio's performance over time. Many investors like to keep track of how companies are performing in general. When a company's share price moves up or down, it shows, whether it is perceived to be lucrative by the investors. |

| Movements in share prices are measured by various indices. These provide a benchmark against which you can compare the performance of your shareholdings. |

| The most quoted index is the KSE-100. It comprises of the 100 largest companies on the Stock Exchange and is updated minute by minute during trading hours. The index reflecting all the companies on the Stock Exchange is the KSE-All Share Index and the KSE-30 Index comprises of top 30 companies. |

| Various investment companies have made their own indices to keep track of the performance of their portfolios. There are three major types of indices calculated to help private investors track the performance of their investment portfolios: |

| 1. The Income Portfolio represents the performance of a portfolio designed to provide a regular flow of income. |

| 2. The Growth Portfolio is for the investor seeking capital growth in his or her portfolio. |

| 3. The Balanced Portfolio represents a balanced portfolio providing both capital and income. |

| The indices are made up of three broad types of asset: Pakistani equities, foreign equities, bonds and PIBs. |

| GENERAL INFORMATION |

| The PSX website http://www.psx.com.pk includes a wide range of information about investing, including information on various market data and Rules & Regulations of the Exchange. |

| WHY SHOULD I INVEST IN SHARES? |

| Almost everyone worldwide has an interest in shares, whether they realize it or not. Millions of people around the world own shares directly. However, many millions more have an indirect stake in the stock market through pension schemes, life insurance policies, NIT units, and other mutual funds. All of these, invest in shares traded on the stock market. |

| Today, increasing number of people own shares around the world, while many more invest in pension schemes, have an insurance policy, National Saving Schemes (NSS) or another form of collective savings invested in shares traded in stock markets. |

| However, investing in shares is different from saving in a bank or National Saving Scheme. There is more risk - but there is the opportunity for better reward over the longer term. With deposit accounts, you earn interest on your capital. When you take your cash back, you get back exactly the same amount that you first deposited (plus the interest it has earned). With shares, you may receive dividends but when you sell those shares, you might get back more than you bought them for, which is your reward for taking a risk. |

| Nevertheless, because shares can go up as well as down in value, it is important to understand that taking a risk means you might get back lesser than you had invested initially. You can minimize your risk by investing in different shares or a collective fund. There is, however, the possibility of greater rewards. Funds invested in equities in the long term (five or more years) have outperformed regular saving accounts. |

| You should remember that saving through the stock market should be seen as a long-term investment. Historically, money invested in shares over the long term (ten or more years) has almost always outperformed regular saving accounts. |

| Before investing in stocks and shares, you should understand your own financial position and what you hope to achieve with your investments. Your regular financial obligations should be protected and preparation should be made for unexpected expenses. |

| Having done this, you are ready to consider investing the surplus in stocks and shares. The three main rationales for owning shares are summarized below: |

| a. Ownership in a Company - when an individual invests in the stock market, he automatically becomes a shareholder of that company. As a stockholder, he is entitled to the following benefits: 1) voting rights; |

| 2) dividends to be declared by the corporation and 3) share of the remaining assets of the company if it is to be liquidated. |

| b. Liquidity of Funds - a stock market investor has easier access to funds. Compared to banks, which have a high minimum balance requirement for deposits and credit, as an individual, you can start an investment with very low capital, and can expect high yields for your initial investment. You can always cash in or out your funds anytime, during trading hours, through your broker. |

| c. Make Money - investors in the stock market make money through dividends and capital appreciation. When a listed company declares dividends, it increases the shareholders' investing power. An investor who buys into the company at a low market price and sells it at a higher price will gain capital appreciation. |

| WHAT ARE THE RISKS OF INVESTING IN STOCKS? |

| While it is true, that stock investment is the most volatile of all securities, investors might well recall the fact that uncertainty, is a permanent feature of any investing perspective. This means that risk is always a part of any investment. A better attitude would be to limit and manage your risk. A maximum level of gain or loss should be set, and calculated decisions should be made when this level is reached. |

| WHAT IS THE MINIMUM AMOUNT OF INITIAL INVESTMENT? |

| Some brokers may require a minimum initial investment to open an account depending on their requirement or may charge or waive other fees depending on the amount you initially invest. |

| If you are just getting started with a small investment, look for an investment firm that would not penalize you based on the size of your investment. |

| The minimum amount of money needed to invest in the stock market depends on the minimum number of shares to be traded for the stock. The minimum shares will be determined by the prevailing market price of a particular stock, as each stock, the minimum number of shares to be traded is fixed, called the market-lot, which depends on the price range of the stock. |

| The market lot is calculated biannually by NCCPL, keeping the lot size to 500-shares for scrip which are priced less than Rs. 50 and lot size of 100-shares for scrip priced above Rs. 50 |

| HOW CAN I BUY AND SELL SHARES? |

| You can buy shares when a company first comes to market - that is at flotation or privatization; or you can buy them through the stock market once they are in circulation and being traded. |

| Companies which are about to issue shares often advertise in a daily newspaper. If you decide to buy these shares, you can seek more information from the company's website or you can fill up the application form at the affiliated bank or ask the company for a prospectus. Fill out the application form and submit it with your pay order, at the bank. There is nothing more to pay. Alternatively, you can go to a stockbroker who will buy them for you. |

| Most share dealings take place in what is called the secondary market. This is where existing shareholders sell and new investors buy. |

| Today, buying shares is easy. You can buy and sell shares by making contact with a stockbroker, bank or investment adviser, either in person or over the internet or telephone. |

| HOW CAN I DECIDE WHICH SHARES TO BUY? |

| 1) A stockbroker carries out buying and selling on his propriety accounts and on behalf of his clients as individuals cannot deal for themselves in the market. A list of stockbrokers is available from the Stock Exchange on PSX website http://www.psx.com.pk. Stockbrokers offer a variety of services but if you know exactly what you want, simply call the broker for an 'execution only' service and ask them to buy the shares of your choice. PSX offers three market segments |

| a) Cash market based on two day clearing and settlement |

| b) Continuous Funding system (CFS) MKII where cash market's net purchases can be carried over for another 22 working days |

| c) Deliverable Future Contracts allow investors to purchase or sale on a forward contract basis clearing and settlement of these contract takes place on last Friday of the months and new contract starts on the following Monday Cash Settled Future Contract where contract is for 90 days, but investor has a choice to enter into any of the three contracts that are always open for end of the month expiry based of cash settlement with under line cash market price of the scrip. |

| 2) After having instructed your broker to buy shares, the broker will draw up contract notes, which typically are sent to your address or mobile phone number within next 24 hours. This will show details of the transaction carried out on your behalf. |

| 3) You must send payment for your shares immediately upon receiving your contract note. In June 2007 the Stock Exchange adopted a two-day settlement system called T+2 system, under which transactions are due for settlement 2 working days after dealing. |

| 4) Upon receipt of payment, the purchased shares are transferred in your name in your Central Depository Company (CDC) account electronically. You are now the proud owner of a portfolio. |

| 5) At this stage you can sell your shares if you wish. You are now entitled to attend the company's Annual |

| General Meeting (AGM). Talk to the other shareholders, especially representatives from the institutional investors. Just one sizeable disinvestment could make all the difference to the outcome of your overall operation. |

| A stockbroker or financial adviser can help you choose which shares to buy, and advice on the best time to sell. |

| You will need to decide: |

| Will I need the money soon? |

| On the other hand, can I leave my money to grow over a number of years? |

| Alternatively, Do I want a combination of both? |

| How much money can I afford to invest? |

| Will I spread this over a small number of shares, or a larger number? |

| Do I want to invest directly in shares? |

| Do I want shares in blue chip companies, medium-sized companies or new, small companies (which can be less secure)? |

| On the other hand, do I want the relatively safe government backed investment schemes available through National Saving System (NSS), or Pakistan Investment Bonds (PIBs)? |

| Am I interested in indirect ways of investing, through closed end Mutual Funds or through Term Finance Certificates available at the Stock Exchange? |

| HOW CAN I FIND A STOCKBROKER? |

| Stockbrokers today have a range of services tailored for the needs of the growing numbers of small shareholders. Some operate from the Stock Exchange Building, some from Queens Road and other similar locations around the city, and some only by telephone. Most large banks offer share-dealing services as well. |

| Before choosing a stockbroker, contact several of them and ask how much they will charge. They expect you to compare their fees with those of other brokers. |

| An individual investor should choose a retail broker, preferably one that meets his requirements in terms of services needed. When he lacks the time to analyze individual companies and stocks, then a full service broker is recommended. In choosing a broker, the investor should see to it that the broker is a member of good standing at the Pakistan Stock Exchange. It is important that the investor should trust |

| his broker and that he is satisfied by the services it is giving him, such as market reports, quality of advice regarding stock selection and timing of purchases and sales, quality of trade executions, on-time delivery of important documents and other services. |

| There are three levels of service you can take: DEALING OR EXECUTION ONLY: |

| You simply call the broker and instruct them to buy or sell the shares you want. They carry out your instructions, but will not give you any advice on your decision. You can always take advice from any other properly qualified financial adviser. |

| ADVISORY: |

| With this service you will get the benefit of the broker's expert advice. They will discuss with you their views on various companies and recommend whether you should buy, sell or keep hold of your shares. Make sure you feel comfortable with and understand what your broker is saying to you. |

| DISCRETIONARY: |

| The broker will take all the buying and selling decisions, contact you regularly to keep you informed, and tell you how much your portfolio is worth. |

| You can get a list of stockbrokers from: |

| 1. The Member's Info section of the Pakistan Stock Exchange Limited (formerly: Karachi Stock Exchanges Limited) (http://www.psx.com.pk) |

| 2. By telephoning the Pakistan Stock Exchange Limited (formerly: Karachi Stock Exchanges Limited) on (+21) 111-00-11-22 |

| 3. By checking with the local branch of your bank or Investment Company. |

| A. WHEN YOU BUY |

| Once you instruct your broker to buy shares, he/she buys the shares for you at the best price available at the time. By the end of day's trading, you will receive a confirmation-note. This shows the details of the transaction. Your broker will indicate when he/she needs to have your money to pay for the shares. |

| B. WHEN YOU SELL |

| Immediately you give your broker an order to sell, he/she again negotiates the best possible price. By the end of day's trading, you receive a contract note confirming the deal. If you hold the share certificate, you must send this to your broker in accordance with his/her instructions. If your shares are held in Central Depository Company (CDC), you will not have a share certificate to worry about. |

| HOW DO I SAFE KEEP THE ACQUIRED SHARES? |

| Once you have bought your shares, there are two ways to hold them: as a certificate or electronically (via CDC account). Your stockbroker can advise which option depending on individual company's shares. |

| Traditionally shares have been held in paper form, known as certificates. A share certificate is a piece of paper that is evidence that you are the owner of the shares. Your name will appear on the company's share register and this entitles you to receive directly all the benefit of share ownership including dividends, the right to vote at a company's annual meeting and to receive company reports twice a year. |

| If you decide to sell your shares you will normally need to deliver the certificate to the broker in time for the transaction to be completed. |

| Today you can choose to hold your shares as an electronic record, receiving a statement from time to time. This is similar to your bank statement, which shows your cash balance as held by the bank. |

| If you choose to hold your shares electronically they are placed in a nominee account with the Central Depository Company (CDC). These accounts are often run by stockbrokers who administer the shareholding on your behalf. You do not have a certificate to keep safe or deliver to your broker in time for the transaction to be completed. You remain the real owner of the shares and you shall receive the dividends, even though the shares are registered in the name of the nominee. |

| Your company also provides you with copies of the company reports and with the right to vote at general meetings. |

| When you have bought or sold the shares, your transaction is completed (or settled) electronically through a service known as National Clearing & Settlement System (NCSS). This system links banks, stockbrokers and Central Depository Company (CDC). |

| HOW MUCH DOES IT COST TO BUY SHARES? |

| Costs of trading in stocks vary according to the level of service you get from your broker. You should select the service that meets your needs. Execution-only will generally be the cheapest service. You will pay more for research base advice. The most important figure to ask your broker is about the minimum commission you will be charged. You should also ask whether there are any other charges for their services. Ask if there are any ongoing costs, other than dealing commission, each time you buy or sell. |

| You should note that you will pay a tax, known as CVT, when you buy shares but not when you sell. This is currently 0.002% percent of the price of the shares. |

| The way you choose to hold your shares will also vary in cost. If you decide to hold a certificate, there may be an additional charge as it will be necessary to transfer it to you or the new owner. |

| HOW CAN I KEEP TRACK OF MY SHARES? |

| Once you have bought shares, you can put them away for a long term or short term, you can keep an eye on how the price is moving. Details of share prices are published in most national newspapers every day. The daily price is also available on our website www.psx.com.pk. |

| The newspapers' financial pages will comment on companies that are in the news - perhaps because they have published their profit figures, or they are subject to a takeover bid, or they have opened a new factory. |

| Every piece of information about your company helps you build a clear picture of how it is doing and is expected to do. In addition, there are several specialist magazines to assist private investors. As a shareholder, and therefore part owner, of a business, you can contact the company if you want further information. Alternatively, your stockbroker might keep you informed through a regular newsletter. |

| HOW ARE SETTLEMENT AND CLEARING DONE? |

| Clearing and settlement of all stock exchange transactions are provided by National Clearing Company (NCCPL), which acts as go between for PSX and Central Depository Company (CDC) which is the share depository company. Shares move between share-accounts held by the different participant-brokers of the Central Depository Company (CDC). |

| Stock market transactions are settled on the second day after the trade. Transfers are based on trades done at PSX. Shares are transferred on settlement date (T+2) to the buyer, and the buyer pays the seller through the clearing banks within the same settlement period. This means that transactions done on Monday must be settled by Wednesday. Settlements of accounts are done in the clearing house through National Clearing & Settlement System (NCSS), which is a fully automated electronic settlement system. Visit NCCPL website for further details regarding clearing and settlement, www.nccpl.com.pk. |

| WHAT IS THE CENTRAL DEPOSITORY COMPANY (CDC) / CENTRAL DEPOSITORY SYSTEM (CDS)? |

| The CDC is a company that operates an electronic share register called the Central Depositary System (CDS). The CDS eliminates the need for physical movement of share certificates. CDC electronically manages book entry system for custody and transfer of securities. CDS was introduced to replace the manual system of physical handling and settlement of shares at the stock exchange and is managed by the Central Depository Company (CDC), which is incorporated under the Central Depositories Act 1997. Investors can open their accounts directly with CDC called Investor Accounts or open sub accounts with a brokerage firm. It has also solved investor problems related to stock handling on the settlement date, registration of shares, and exercise of corporate action benefits. Visit CDC website for further details regarding shares safe keeping. (www.cdcpakistan.com). |

| TAXES AND LEGAL ASPECTS |

| INCOME TAX |

| When you receive your dividend cheque, income tax has already been deducted by the company at basic rate. Basic-rate taxpayers have nothing more to pay. |

| Higher-rate taxpayers have to pay the difference between basic and higher rate at the end of the tax year. |

| Non-taxpayers can reclaim the tax deducted through their local tax office. CAPITAL GAIN TAX |

| You make a capital gain when you sell shares at a higher price than you are paid. If you sell at a lower price, you make a loss. |

| Tax is a very complex subject - you should always speak to a properly qualified tax adviser to make sure you have a complete picture of the tax rules. |

| WHO IS INELIGIBLE TO OPEN A TRADING ACCOUNT? |

| Upon discovering that an investor fits any of the descriptions below, the stockbroker should refuse to accept his or her application to open an account, or refuse to take orders from such customer to buy, sell or subscribe securities: |

| Minors who do not have the authorization of their legal guardian |

| Personnel or employees of the authorities in charge of securities matters and regulators |

| Person is declared bankrupt and rights have not been reinstated |

| A person's opening an account that cannot supply proof of his identity |

| Securities dealer who have not been approved by the competent authority. DISPUTE RESOLUTIONS: |

| HOW DOES THE CLIENT KNOW IF HE/SHE HAS A CASE AGAINST STOCK EXCHANGE MEMBER? |

| Just because the client has lost money while dealing in securities doesn't mean that he/she has a case against the member. The financial markets have always gone through periodic down turns and upturns and these fluctuations are not always the fault of member. However, it is the responsibility of a member to invest money according to the client's instructions. There are certain malpractices against which a client can lodge a complaint such as: |

| Unauthorized trading (Sale/Purchase) |

| Unauthorized transfer/movement of shares |

| Non-supply of statements of account |

| Non-supply of trade confirmations within 24 hours |

| Overcharged commission |

| Failure to execute investors' instructions/orders |

| Suspension of payment |

| Non-Delivery of securities. |

| WHAT ARE THE DIFFERENT WAYS TO HANDLE A PROBLEM WITH STOCK EXCHANGE MEMBER? |

| 1. AMICABLE SETTLEMENT: |

| Although the client has the recourse to approach the relevant stock exchange, SECP or the Courts for lodging complaint, it is strongly advised that the complaint/problem should first be taken up directly with the member. This will not only save the time consumed in correspondence and procedures but will also preserve the trust and confidence. |

| 2. ARBITRATION COMMITTEES OF STOCK EXCHANGES: |

| The client also has the alternative of taking up his/her complaint with the management of the concerned stock exchange. All the stock exchanges have their own Arbitration Committees that look into the grievances/disputes between the Investor and the Members. |

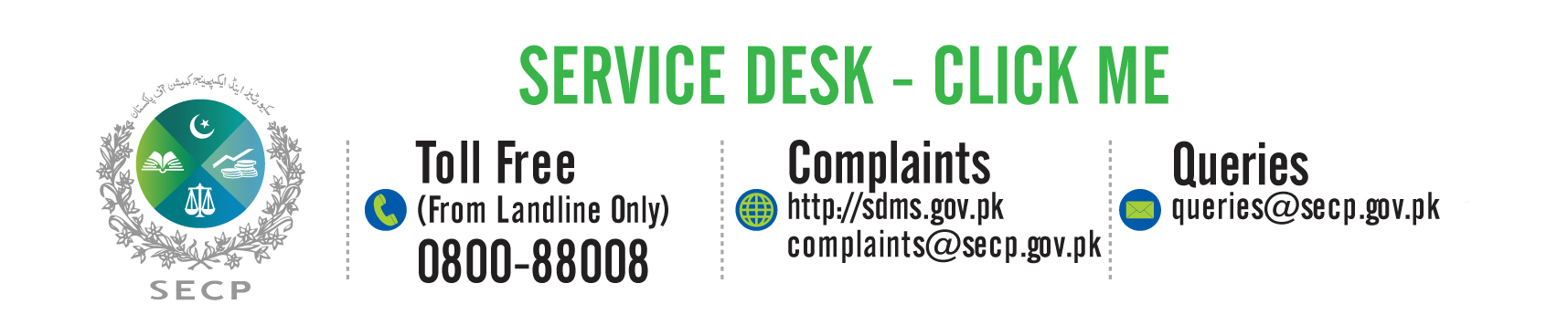

| 3. SECP: |

| The client can also lodge his/her complaint with the Vigilance Cell which has been setup at SECP to ensure that grievances/complaints of the general public are heard and redressed, in a quick and efficient manner. All the complaints received by the Vigilance Cell against Stock Exchange members are forwarded to the Investor Complaint Wing (ICW) of the Securities Market Division (SMD) for further processing. However, SECP is not empowered to force the member for compensation/damages. |

| 4. CIVIL COURTS: |

| The client can also file his/her complaint with the Civil Courts. |

| WHAT ARE DIFFERENT FORUMS AVAILABLE FOR PURSUING A CLAIM AGAINST STOCK EXCHANGE? |

| There are three forums available for pursuing claims against Stock Exchange members: |

| 1. ARBITRATION COMMITTEES OF STOCK EXCHANGES: |

| The Stock Exchanges are Self-Regulatory Organizations (SROs) empowered to take cognizance of complaints against the members under the approved Rules and Regulations. All the Stock Exchanges have their own Arbitration Committees that look into the grievances/disputes between investor and members. Arbitration Committees after perusing the documents and providing the parties an opportunity of being heard pass an Arbitration Award in accordance with the relevant Rules and Regulations of the Exchange. |

| 2. SECP: |

| The SECP has established a Vigilance Cell which is responsible for ensuring that grievances/complaints of the general public are heard and redressed, in a quick and efficient manner. The client can file his/her complaint with the Vigilance Cell against Stock Exchange members on the prescribed Complaint Registration form (CRF) which is available, free of cost in the offices of Stock Exchanges and the Commission including the Company Registration offices (CROs). CRF may be downloaded from the official website of SECP: http://www.secp.gov.pk/ComplaintForm1.htm. The ICW after perusing the documents and giving the parties an opportunity of being heard passes an Order according to the relevant Rules and Regulations. Any party dissatisfied with the Order can file an appeal before the Appellate Bench of the Commission within thirty days from the date of issue of such Order under Section 33 of the SECP Act, 1997. |

| 3. CIVIL COURTS: |

| The client can also file his/her complaint with the Civil or Criminal Court. However this forum is more appropriate for claiming compensation or damages. |

| WHAT IS ARBITRATION? |

| Arbitration is an alternative dispute resolution mechanism provided by the Exchanges for those persons who do not wish to go to Court. Through this method disputes between the trading members and between trading members and their constituents (i.e. clients of trading members), may be addressed and resolved in respect of trades done on the Exchange. This process of resolving a dispute is comparatively faster than litigation. |

| WHO ARE THE PERSONS WHO CAN ACT AS ARBITRATORS? |

| The Arbitrators are members and management of the Exchange and non-member directors of the Exchange. For further details please refer to Regulation 29 of the General Rules & Regulations of Pakistan Stock Exchange Limited (formerly: Karachi Stock Exchange Limited) |

| Disclaimer: The information contained herein is subject to change without prior notice. While every effort is made to ensure accuracy and completeness of information contained, the Commission makes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information for any claim, demand or cause of action. |